The once sizzling US housing market has shown signs that the party may be over. Is a looming US house crash coming in 2022-23? Let’s first take a look at the US housing market data in charts and see where it is at today.

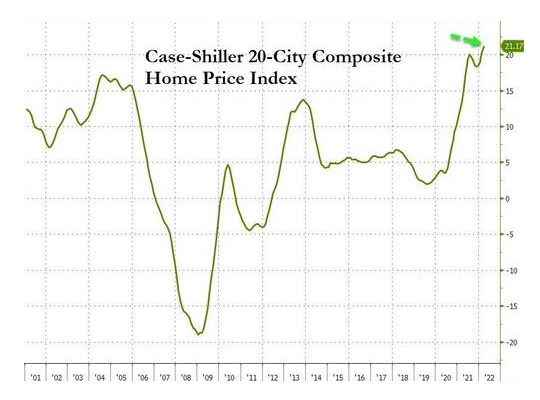

Are home prices still holding? The Case-Shiller 20-City Composite surged 2.42% MoM (more than the 1.93% expected) and surged by a record 21.17% YoY (more than the +20% expected). Moderating demand is still playing a role. Still, homes spend less time on the market than a year ago, and prices are still rising. See this in the chart below and learn more here.

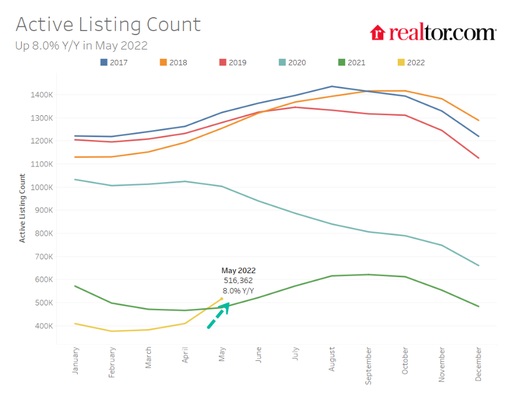

And what of housing supply? Realtor.com reveals national inventory of active listings increased by 8.0% in May over the same month last year. It explained a “major turning point in inventory” has arrived, and sellers are fueling this turnaround in inventory, with newly listed homes entering the market at a rate not seen since 2019. One can see this in the chart below.

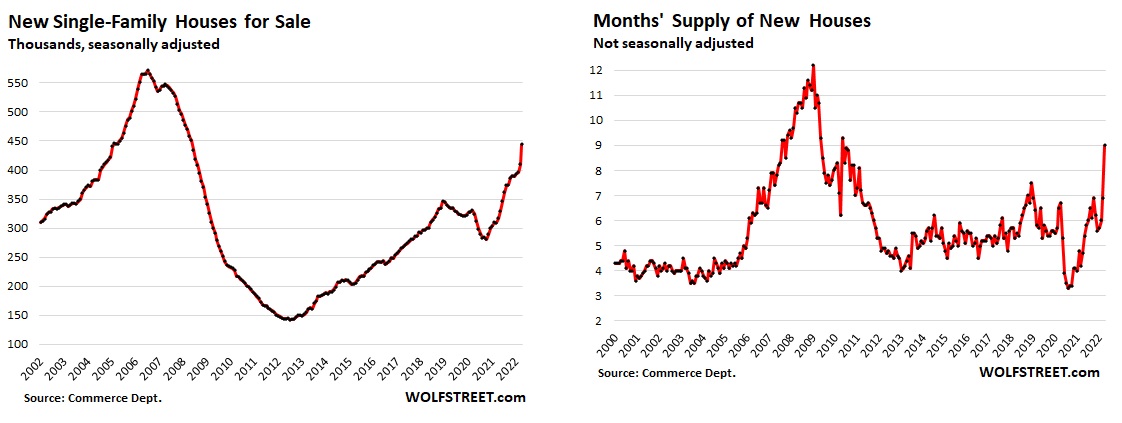

Both the month-to-month leap and the year-over-year leap were the largest leaps ever recorded, both in numbers of unsold houses and in percentages. The supply of unsold new houses spiked in a historic month-to-month leap from an already high 6.9 months supply in March to a dizzying 9.0 months supply in April, having nearly doubled from a year ago. Hence, the housing supply is growing, as can be seen in the charts below.

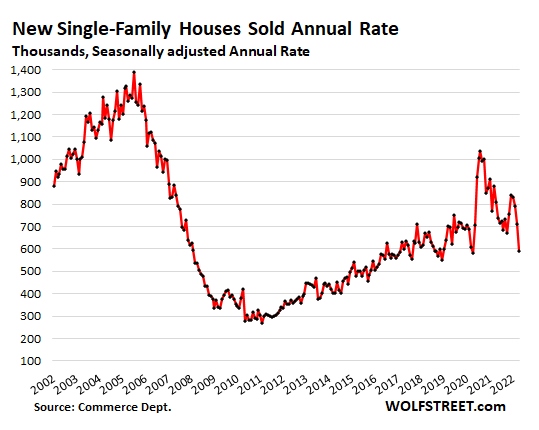

And what of housing demand? Sales of new houses are registered when contracts are signed, not when deals close and can serve as an early indicator of the overall housing market. See this in the chart below and learn more here.

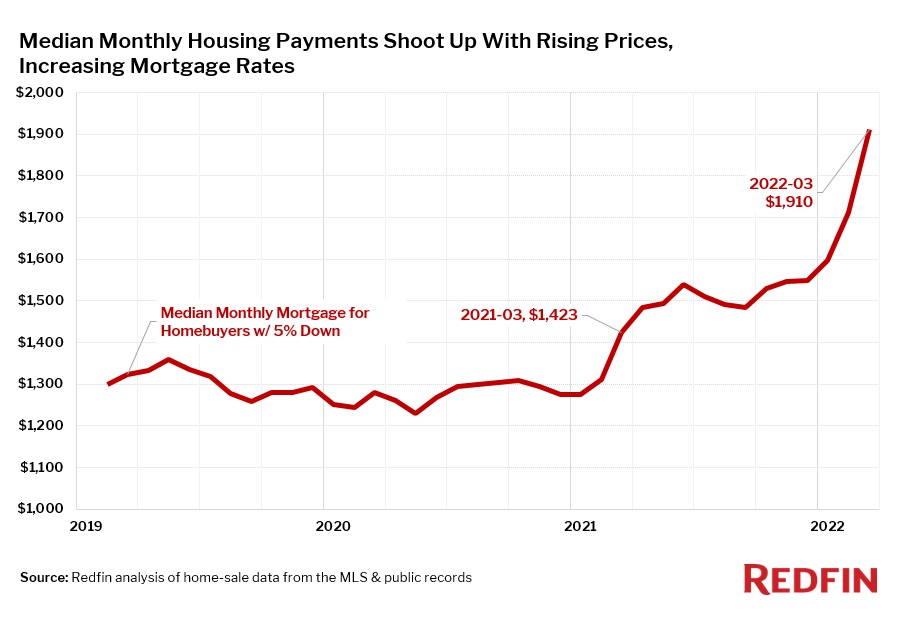

What is the home financing picture? Often looking at housing prices alone does not tell the story. At the end of the day, people look at what their house payment will be. The combination of skyrocketing prices and rising mortgage rates caused the typical monthly mortgage payment to reach $1,910 in March 2022, up from $1,423 in March 2021 and $1,280 in March 2020. See this in the chart below and learn more here.

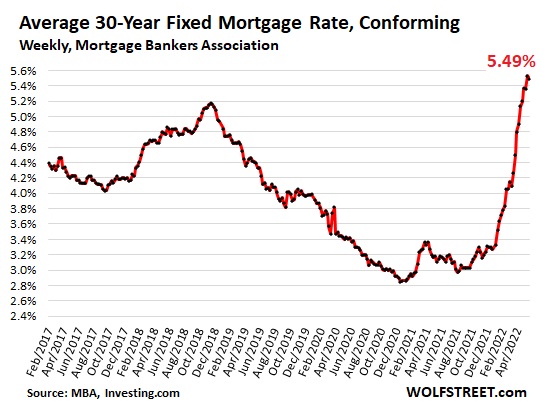

Homebuyers struggle with spiking mortgage rates which make the high home prices that much more difficult to deal with. And with each increase in mortgage rates and with each increase in home prices, entire layers of potential buyers abandon the market, and sales volume plunges. See the home mortgage rate trend in the chart below.

Homebuyers struggle with spiking mortgage rates which make the high home prices that much more difficult to deal with. And with each increase in mortgage rates and with each increase in home prices, entire layers of potential buyers abandon the market, and sales volume plunges. See the home mortgage rate trend in the chart below.

From all this data, one could easily postulate that we are at some inflection point in the housing market. For sure there could be significant softening in the housing market coming – but is a severe housing crash in the cards? Here are a few takeaways to consider.

From all this data, one could easily postulate that we are at some inflection point in the housing market. For sure there could be significant softening in the housing market coming – but is a severe housing crash in the cards? Here are a few takeaways to consider.

- Softening housing market – is definitely in the cards over the next six to eighteen months. If you need to move, you better do it quickly now, or the opportunity will pass until the next cycle.

- No severe housing crash – could be the state of play as it was in 2008. In 2008 there was a huge build-up in shakey credit mortgage risk that isn’t the same in today’s housing market. This credit risk forced sales that crashed prices in 2008.

- A different kind of recession coming – the coming recession may not be a job loss recession as in the past. Though some job losses will occur, the coming recession will be more of a wage loss (20 to 50% in purchasing power) recession relative to everything else you buy.

- Zombie homes – could be the state of play. If you are in a home (with a low mortgage rate) and job, for the most part, it will stay stagnant. Your mobility will be limited. To sell and buy again will be cost-prohibitive. When you do eventually move, most will need to rent or trade down their housing purchases.

- Increased corporate housing ownership – will become the norm, as private ownership of homes will take a sharp decline. Most of the middle class will become renters.

- Continued rising home prices – after six to eighteen months, prices could accelerate again under continued government and Fed currency debasement schemes.

- New taxes – such as unrealized capital gains, will ensure that those who think they have hedged for the housing inflation may not win either.

Time will tell the story of what eventually plays out in the housing market.

See more Chart of the Day posts.

This story syndicated with permission from Gen Z Conservative