As a conservative who lives on the left coast in California, the changes in what used to be the Golden state are depressing for those who can remember the booming 1980s during President Ronald Reagan’s eight years in office.

California and 48 other states voted for Reagan’s re-election in 1984.

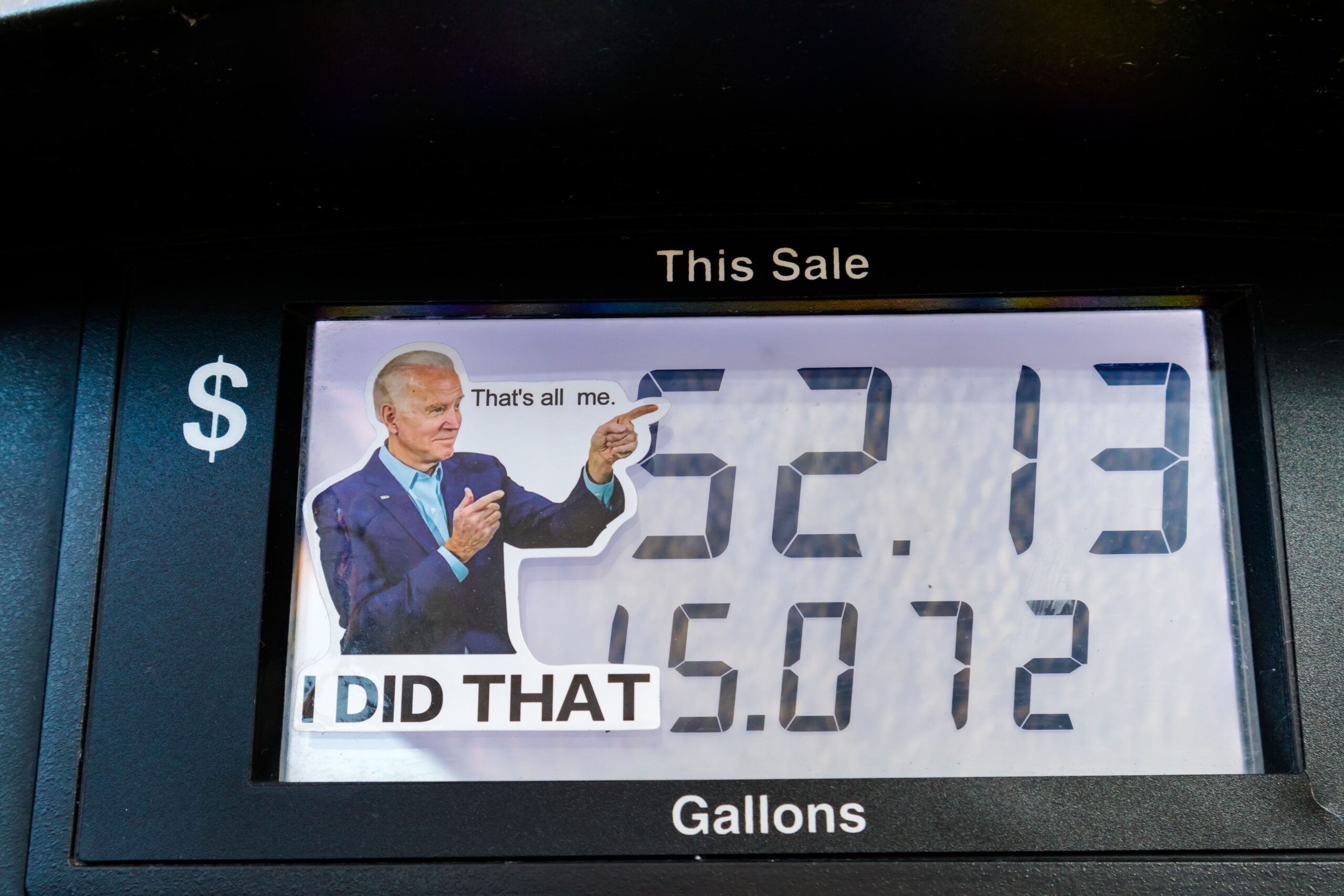

In his first 17 months in office, President Joe Biden has mismanaged the U.S. economy, energy production, illegal immigration, and endless domestic and foreign policy decisions.

In addition to the administration’s disastrous and confusing withdrawal from Afghanistan, Biden stopped the construction of the XL Keystone pipeline on day one.

This decision angered many in the energy sector, as they had just won approval after ten years of fighting the bureaucracy. It was expected to transport 830,000 barrels of Alberta, Canada oil per day to refineries on the Gulf Coast of Texas.

In addition, the administration has been fighting to cancel existing and prevent new oil and natural gas leases from being awarded.

In California, it is becoming difficult to find a gas station under $6 per gallon, up from the $3.62 per gallon average we enjoyed in the middle of President Trump’s term in office.

Yardeni Research concluded that Americans are paying considerably more at the pump this year.

By Yardeni Research’s estimates, Americans were spending $2,800 in 2021.

Last March, Americans were expected to pay an estimated $3,800 at the pump in 2022.

With the huge jump in inflation, U.S. households are now expected to spend an average of $5,000 on gasoline instead.

AAA reported that the national average for a gallon of regular gasoline in March was $4.22. A year ago, at this time, a gallon of gas was $3.04.

“No wonder the Consumer Sentiment Index is so depressed. The wonder is that retail sales have been so surprisingly strong during April and May,” Yardeni said in a note.

Yardeni stated that the inflation-adjusted incomes of most consumers are barely growing, requiring them to charge the extra inflationary costs on their credit cards.

However, similar to those who put on weight or drink too much when stressed out, Yardeni’s study indicates that the American consumers’ spending went up, which might give the economy an illusion of strength.

Yardeni stated, “When we are happy, we spend money. When we are depressed, we spend even more money!”

Gasoline sales had declined in April, but then ramped up to the record levels in May. According to data from the Department of Commerce, spending on gasoline in April increased by nearly 37% from a year ago.

Not only are Americans paying more for necessary products, like gasoline, but their earnings in real wages are falling rapidly.

The average hourly earnings for employees on private nonfarm payrolls are falling behind. Their payrolls rose only 0.3% in April, far lower than April’s inflationary rate of 8.3% and what economists had forecast.

With each passing week, more and more economists are warning of a possible recession.

The problem is the administration doesn’t appear to have a coherent plan for turning things around.

So-called preppers might end up not being the crazy ones. After all, it might be the majority fighting over food because they trusted in the progressive’s policies.

By: Eric Thompson, editor of EricThompsonShow.com. Follow me on Twitter and MagaBook

This story syndicated with permission from Eric Thompson, Author at Trending Politics