Consumer Price Index CPI in the United States increased to 7.9% year-on-year in February of 2022 – its last report. Some have said in the past that the current inflation rate is temporary – or transitory. But what of inflation future expectations? Well, Psaki gave us a warning that turned out to be true: inflation is gonna be even worse than it already is:

NOW – White House warns of “extraordinarily elevated” inflation data.pic.twitter.com/3ZDqpHFgoc

— Disclose.tv (@disclosetv) April 11, 2022

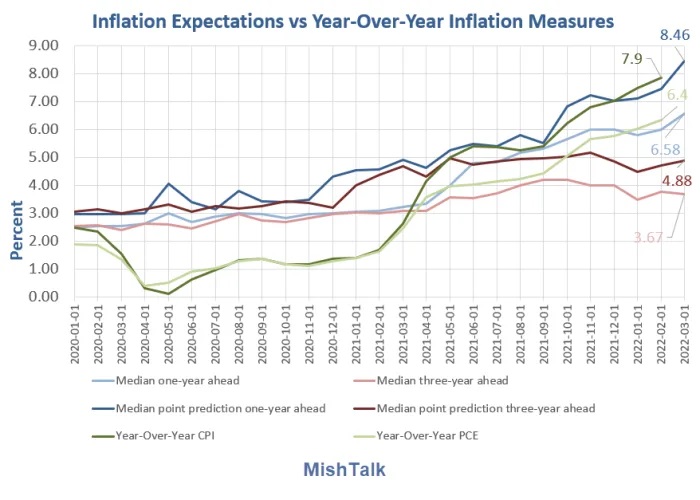

The Federal Reserve (Fed) does track future expectations for inflation rates. The New York Fed released the Survey of Consumer Expectations for interest rates as of March 2022. The below chart has been created from this data.

Note the green lines (CPI and CPE) are the current CPI rate and the other lines are showing expectations depending on the duration of the expectation. The Fed’s current shocking one-year prediction inflation rate is 8.46%. See this in the chart below and learn more here.

That predicted increase in inflation turned out to be correct, as infaltion just hit a massive 8.5%, as MarketWatch reported, saying:

The rate of U.S. inflation leaped to 40-year high of 8.5% in March and showed little sign of easing up, explaining the new-found urgency at the Federal Reserve to quickly undo its easy-money strategy.

The consumer price index jumped 1.2% last month, driven by the higher cost of gasoline, food and housing, the government said Tuesday. It was the largest monthly gain since Hurricane Katrina in 2005.

The rise in the cost of living has been hitting new highs for months. The rate of inflation in the past year moved up to 8.5% in March from 7.9%. The last time inflation topped 8% was in January 1982, when Ronald Reagan was president.

The Fed keeps repeating its line inflation expectations are well anchored. Let’s tune in to the March 2022 FOMC Minutes for examples.

- A few participants commented that both survey- and market-based measures of short-term inflation expectations were at historically high levels. Several other participants noted that longer-term measures of inflation expectations from households, professional forecasters, and market participants still appeared to remain well-anchored, which—together with appropriate monetary policy and an eventual easing of supply constraints—would support a return of inflation over time to levels consistent with the Committee’s longer-run goal.

- Recent COVID-related lockdowns in China that had the potential to further disrupt supply chains; and the possibility that longer-run inflation expectations might become unanchored.

- Participants judged that the firming of monetary policy, alongside an eventual waning of supply-demand imbalances, would help to keep longer-term inflation expectations anchored and bring inflation down over time to levels consistent with the Committee’s 2 percent longer-run goal while sustaining a strong labor market.

- A few participants judged that, at the current juncture, a significant risk facing the Committee was that elevated inflation and inflation expectations could become entrenched if the public began to question the Committee’s resolve to adjust the stance of policy as appropriate to achieve the Committee’s 2 percent longer-run objective for inflation.

The New York Fed survey already shows inflation expectations are not anchored. Even the three-year median point projection is 4.88%, well over the Fed’s target rate of 2.00%.

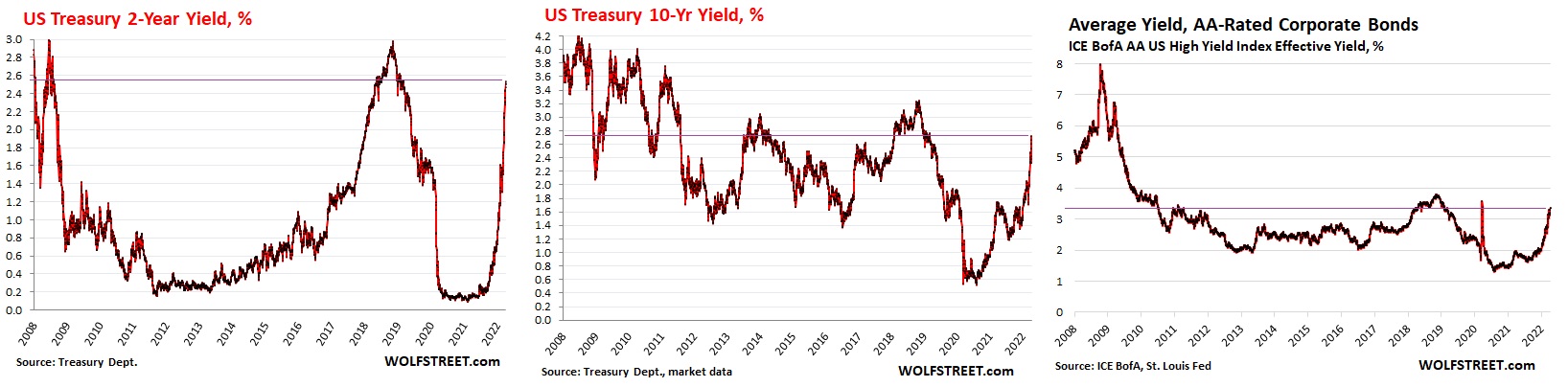

The Fed has been pushing up interest rates in response to the current inflation situation. See below for both government (2 and 10 year durations) and corporate bond rates – learn more here.

The obvious results of these rising rates will be to induce a recession, cooling price rises, though the Fed believes it may be mild – threading the needle.

However, if the recession gets severe enough, they may stop the rate rises and then risk even more currency debasement and its subsequent inflationary effects. No doubt politics will be in play, even if we think the Fed is politically independent as advertised.

The economic system is so far out of wack, that it will force the Fed at some point to take a direction in the “Y” in the road ahead – severe recession or severe inflation.

Which direction in the “Y” in the road will the Fed take?

See more Chart of the Day posts.

This story syndicated with permission from Gen Z Conservative